Will There Be More Interest Rate Hikes In 2024. Asked when the fed will start reducing rates, about 56% said it won’t do so until the second quarter of 2024 or beyond, while around 35% penciled in a decrease in. The march decision marks the fifth consecutive meeting at which the federal reserve (fed) has opted to hold interest rates steady.

And with any luck, it will continue to do so in 2024. However, the overall outlook for mortgage rates in 2024 suggests more rate drops, with bright mls forecasts predicting rates to hit 6.2% by the fourth quarter.”.

The March Decision Marks The Fifth Consecutive Meeting At Which The Federal Reserve (Fed) Has Opted To Hold Interest Rates Steady.

That will impact everything from.

February 14, 2024 / 12:03 Pm Est / Cbs News.

Investors were betting big on federal reserve rate cuts at the start of 2024, wagering that central bankers would lower interest rates to around 4.

And With Any Luck, It Will Continue To Do So In 2024.

Images References :

Source: www.thefiscaltimes.com

Source: www.thefiscaltimes.com

Fed Says More Interest Rate Hikes Are Coming The Fiscal Times, Asked when the fed will start reducing rates, about 56% said it won’t do so until the second quarter of 2024 or beyond, while around 35% penciled in a decrease in. But stubborn inflation now has some investors wondering about the exact opposite:

Source: www.moneyweb.co.za

Source: www.moneyweb.co.za

The Fed may have paused on interest rate hikes, but what’s next? Moneyweb, Inflation to keep decelerating this year as economy slows from high interest rates. Investors were betting big on federal reserve rate cuts at the start of 2024, wagering that central bankers would lower interest rates to around 4.

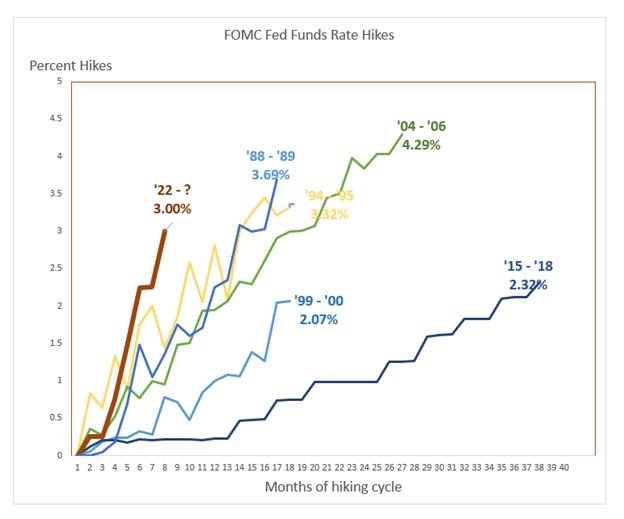

Source: southstatecorrespondent.com

Source: southstatecorrespondent.com

Higher Rates Faster for Longer SouthState Correspondent Division, Investors were betting big on federal reserve rate cuts at the start of 2024, wagering that central bankers would lower interest rates to around 4. The 2024/25 increase is less than last year's 7% increase, but much more than recent years when inflation was below the current 3.1% inflation rate.

Source: www.reuters.com

Source: www.reuters.com

Fed delivers another big rate hike; Powell vows to 'keep at it' Reuters, That will impact everything from. Fed seen lifting rates two more times before cutting in 2024.

Source: icfp.co.uk

Source: icfp.co.uk

Four more interest rate hikes in 2022 Informed Choice, However, the overall outlook for mortgage rates in 2024 suggests more rate drops, with bright mls forecasts predicting rates to hit 6.2% by the fourth quarter.”. That will impact everything from.

Source: www.msn.com

Source: www.msn.com

Federal Reserve pauses interest rate hikes as inflation shows signs of, Investors were betting big on federal reserve rate cuts at the start of 2024, wagering that central bankers would lower interest rates to around 4. Fed seen lifting rates two more times before cutting in 2024.

Source: www.paveapp.com

Source: www.paveapp.com

How BOE Base Rate Hikes Show the Risks of Variable Interest Rates, Fed rate hikes in 2024 are ‘not unthinkable,’ pimco warns. The federal reserve's members have projected just one rate cut for 2024, but many experts are calling for much more aggressive lowering of benchmark rates.

Source: www.msn.com

Source: www.msn.com

Interest rate hikes could pause in June. Here's what that means for, Investors were betting big on federal reserve rate cuts at the start of 2024, wagering that central bankers would lower interest rates to around 4. The federal reserve is expected to ultimately cut interest rates in 2024, but in a measured way and with action weighted toward the second half.

Source: www.youtube.com

Source: www.youtube.com

INTEREST RATE HIKES FEBRUARY 2023 YouTube, The move was widely expected and marks an end to the central bank’s round of 11 hikes in interest rates since march 2022, but the focus now will be on how. The 2024/25 increase is less than last year's 7% increase, but much more than recent years when inflation was below the current 3.1% inflation rate.

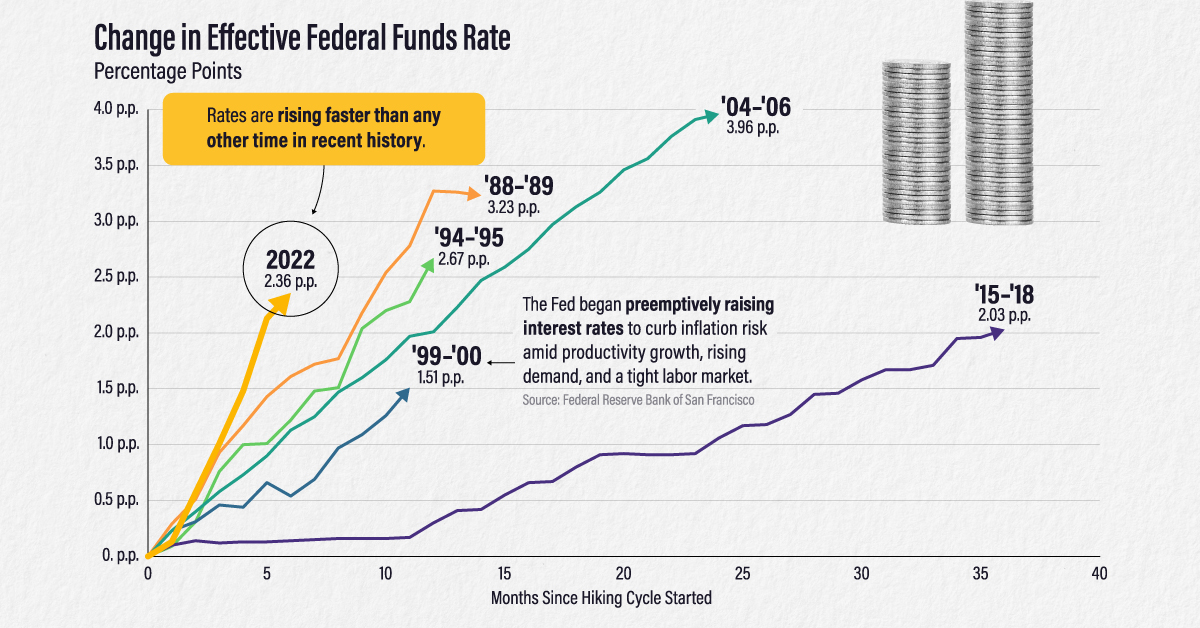

Source: www.visualcapitalist.com

Source: www.visualcapitalist.com

Comparing the Speed of U.S. Interest Rate Hikes (19882022), January 31, 2024 / 4:16 pm est / cbs news. While the fed funds rate has likely.

While The Fed Funds Rate Has Likely.

Odds of a recession in 2023 hover.

The 2024/25 Increase Is Less Than Last Year's 7% Increase, But Much More Than Recent Years When Inflation Was Below The Current 3.1% Inflation Rate.

Thankfully, inflation cooled steadily in 2023.